Is Real Estate a Good Investment in India?

Introduction: Why This Question Matters More Than Ever

You’ve worked hard to save money. Naturally, you want stability. You want your income to grow over time—not slowly lose value to inflation. At some point, almost every Indian reaches the same crossroads and asks: is real estate a good investment in India?

This question usually comes from uncertainty. Stock markets can feel unpredictable. Fixed deposits no longer offer meaningful growth. New-age investments appear complex and risky. Real estate, on the other hand, feels familiar and dependable—but also expensive and long-term.

This uncertainty often leads to hesitation.

This article is written to bring clarity. It explains how real estate investment works in India, where it truly makes sense, where it may not, and how investors can approach property decisions realistically—without hype, shortcuts, or unrealistic expectations.Why Indians Traditionally Prefer Property as an Asset

In India, real estate has never been viewed as just another investment option. Property represents security, permanence, and long-term wealth preservation. Unlike paper assets, real estate is tangible. You can see it, live in it, rent it, or pass it on to the next generation.

For decades, Indian families have relied on land and homes to protect wealth against inflation and economic uncertainty. This deep-rooted trust is one of the key reasons property continues to remain a preferred asset class across generations.

Investment Mindset vs End-Use Buying

One common mistake buyers make is not distinguishing between buying a home to live in and buying property as an investment.

End-use buyers focus on comfort, lifestyle, emotional satisfaction, and daily convenience. Investment buyers, on the other hand, look closely at location quality, future demand, appreciation potential, and financial risk.

A property can serve both purposes—but clarity of intent before buying is essential. Knowing why you are buying helps you make better decisions and avoid regret later.

Understanding Real Estate as an Investment

What Real Estate Investment Means in India

At its core, real estate investment means purchasing property with the expectation that it will create value over time. This value typically comes from two sources.

The first is rental income, which provides regular cash flow. The second is capital appreciation, where the property’s value increases over the long term due to demand, development, and infrastructure growth.

In India, property investment broadly falls into three categories: residential property, commercial property, and land or plots. Each option has a different entry cost, risk profile, and return behavior.

Income vs Appreciation: How Value Is Built

Some properties generate stable rental income but see slower price growth. Others may offer modest rent but experience strong appreciation due to improved connectivity or neighbourhood development.

Understanding this balance is important. Real estate is not designed for frequent buying and selling. It rewards investors who think long term and hold quality assets patiently.

How Investing in Property Actually Works

The Real-Life Investment Cycle

Most real estate investments follow a simple path. A buyer purchases a property, holds it over time, benefits from rental income or appreciation, and eventually exits when the value has matured.

There is no overnight success. Value builds gradually as surrounding areas develop, demand increases, and infrastructure improves.

Why Location Matters More Than Timing

Many investors try to time the market. In real estate, location almost always matters more than timing.

Properties located near employment hubs, educational institutions, healthcare facilities, and well-planned infrastructure tend to perform consistently well over time—even during slow market phases.

Patience Is the Real Advantage

Unlike volatile assets, real estate rewards patience. Investors who hold quality properties through growth cycles generally benefit far more than those chasing quick exits or short-term gains.

Is Real Estate a Good Investment in India Today?

Why Property Continues to Attract Long-Term Investors

One of the biggest advantages of real estate is that it is a tangible, inflation-resistant asset. As costs rise over time, property values and rental incomes tend to rise as well, helping preserve purchasing power.

India’s growing urban population also continues to fuel housing demand, especially in well-connected cities and emerging corridors. Compared to highly volatile assets, real estate offers relative stability, making it attractive for long-term wealth creation.

When Real Estate May Not Be the Right Choice

Real estate is not suitable for everyone—and acknowledging this builds trust.

If you are expecting quick returns, need high liquidity, or are depending heavily on loans without financial flexibility, property investment can feel restrictive. Over-leveraging and unrealistic expectations remain the biggest risks in real estate.

Which Real Estate Investment Is Best in India?

Residential Property

Residential real estate remains the most suitable choice for first-time buyers and conservative investors. It benefits from strong end-user demand, rental potential, and relatively lower risk compared to other property formats.

Apartments in well-planned residential developments also offer lifestyle value alongside long-term investment potential, which is why they continue to attract buyers.

Commercial Property

Commercial properties can offer higher rental yields, but they also involve higher ticket sizes, market dependency, and vacancy risk. These factors make them more suitable for experienced investors rather than beginners.

Land and Plots: A Cautious Approach

Land investments are driven mainly by appreciation. However, legal verification can be complex, liquidity is lower, and development timelines are uncertain. For many first-time investors, land may not be the most practical option.

How to Start Investing in Property in India

For first-time buyers, the journey should begin with affordability rather than aspiration. Beyond the purchase price, long-term financial comfort matters.

Understanding loan eligibility, planning a realistic down payment, and ensuring that approvals and legal documents are in place—especially RERA compliance—are critical steps.

Why Location Beats “Cheap Deals”

A lower price does not always mean better value. Properties in areas with strong infrastructure growth, good connectivity, and long-term livability often outperform cheaper but poorly connected locations over time.

How to Invest in Property With Limited Capital

For buyers with budget constraints, realistic entry options include joint ownership with family members, choosing smaller residential units, or considering under-construction projects after careful due diligence.

What should be avoided are promises of “small money, big returns,” informal schemes, or decisions driven purely by hype. Real estate rewards discipline, not shortcuts.

Alternative & Modern Property Investment Options

Pooled or fractional real estate investing allows multiple investors to collectively own a property. While this lowers entry barriers, it also comes with limited control, exit restrictions, and platform risk.

Such options may suit investors seeking exposure without ownership, but they do not replace traditional property ownership for long-term stability.

H2: Real Estate Investment Examples in India

In real life, property investments often take simple forms. A self-occupied home gradually becomes a long-term family asset. A residential flat generates steady rental income. A property bought early in a developing locality benefits as the area grows.

These examples highlight that value creation in real estate is gradual, not instant.

Common Questions & Misconceptions

Real estate does not need to outperform every asset to be valuable. Its strength lies in stability, predictability, and long-term growth. It is also not limited to the wealthy—but it does require planning, patience, and disciplined decision-making.

Explore a Thoughtfully Planned Residential Opportunity in Pune

For investors who believe in location-driven, long-term real estate decisions, the quality of the project matters as much as the asset class itself.

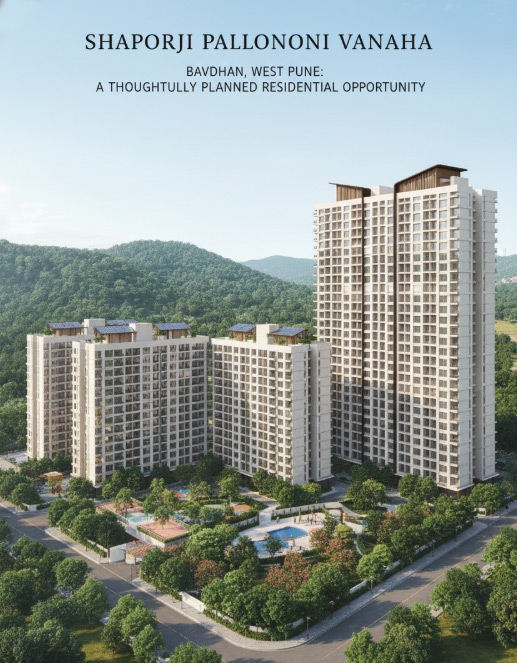

Developments like Shapoorji Pallonji Vanaha reflect what disciplined property investing looks like—planned infrastructure, strong connectivity, and a focus on sustainable living. Located in Bavdhan, West Pune, the township is designed for homeowners and long-term investors who value future growth over short-term speculation.

Exploring a reputed, well-planned residential development can help you make a confident and informed investment decision.

H2: Final Verdict: Should You Invest in Real Estate in India?

Real estate is well-suited for long-term investors, end-users seeking stability, and those who value tangible assets with steady growth. It may not suit short-term traders or those who need high liquidity.

The most successful property investments are location-driven, well-researched, and patiently held.

Frequently Asked Questions (FAQs)

1. Is real estate a good investment in India for the long term?

Yes, real estate can be a good long-term investment in India when bought in the right location and held patiently. Property tends to protect wealth against inflation and benefits from urban growth, infrastructure development, and rising housing demand. However, returns are gradual and suit investors with a long-term mindset rather than those seeking quick profits.

2. Is real estate better than stocks or mutual funds in India?

Real estate and financial markets serve different purposes. Stocks and mutual funds offer higher liquidity and potentially faster returns but come with higher volatility. Real estate provides stability, tangible ownership, and long-term appreciation. Many investors use property as a wealth-preservation asset rather than a high-frequency return generator.

3. How much return can I expect from real estate investment in India?

Real estate returns in India vary by location, property type, and holding period. Rental yields are typically moderate, while capital appreciation builds slowly over time. Well-located properties in growing urban corridors tend to deliver better long-term value compared to speculative or poorly connected areas.

4. Is now a good time to invest in real estate in India?

The right time to invest depends more on location quality and financial readiness than market timing. Properties in well-planned developments with strong infrastructure and future growth potential tend to perform well regardless of short-term market cycles. Buyers should focus on long-term fundamentals rather than short-term price movements.

5. What are the biggest risks of real estate investment in India?

Major risks include poor location selection, legal or documentation issues, over-leveraging through loans, low liquidity, and unrealistic return expectations. Conducting proper due diligence, verifying RERA compliance, and choosing reputable developers significantly reduce these risks.

6. Is real estate investment suitable for first-time investors in India?

Yes, real estate can be suitable for first-time investors if approached cautiously. Residential property is generally the safest entry point due to consistent end-user demand and lower complexity. First-time buyers should prioritise affordability, legal clarity, and long-term livability over speculative gains.